Top Best Buy Now, Pay Later Apps in 2022

Feb 09, 2024 By Triston Martin

Several companies have teamed up with "buy now, pay later" (BNPL) applications to make online shopping more convenient for their customers. You may purchase something now and pay for it later using these BNPL applications, which are analogous to credit cards in that respect. However, one of the most significant distinctions is that most do not impose interest as far as you pay your monthly payments. It's simple to use the BNPL applications, and the charges &' interest rates are modest so that you may utilize the credit for everyday expenditures. Below are the Best Buy Now, Pay Later Apps in 2022.

Top BNPL Apps

Affirm

Affirm is a buy-now, pay-later application that was launched in 2012. For purchases under $17,500, you may use Affirm to spread out the payment and choose from a variety of repayment options. You have the option of making monthly payments over a period of three, six, or twelve months. Affirm runs a soft credit verification and a soft credit draw on applicants; however, neither action will adversely affect your credit score. Making a purchase utilizing an Affirm loan, on the other hand, might have an influence on your credit rating, so ensure you keep up with your monthly loan amounts to keep developing your credit. Affirm does not impose any fees whatsoever, like late charges, prepayment costs, or yearly fees. Your payment program, the value of your transaction, and where you buy all factor into whether or not you'll be charged interest. There are no surprises when it comes to owing interest.

Afterpay

When Afterpay was created in Australia in 2014, it quickly spread to the United States, Canada, the United Kingdom, New Zealand, and the European Union under the name Clearpay. Purchases may be paid for in four installments over the course of six weeks. In addition, you won't have to pay a cent in interest with this service, unlike other purchases now, pay later options. To use Afterpay, you must shop the same way you usually would at participating businesses, online or in person. When you are willing to check out, you will make one of four installments. After that, you'll have to pay for the next six weeks every two weeks.

Using Afterpay will have no effect on your credit score since it does not conduct credit checks or record late payments. Starting at $500, the application's spending limitations rise as you exercise fiscal restraint. Please remember that Afterpay charges a late payment penalty of 25 percent of your original purchase value or $7.80, whichever is greater.

Klarna

Klarna is another widely used software for making purchases now and paying for them later. After a decade of development, it was introduced in the United States in 2005. In comparison to its rivals, Klarna offers a wide range of repayment options. In the first place, you have the option of paying for your purchase over four weeks with interest-free installments. You won't be charged interest if you choose this payment plan. Alternatively, you may opt to purchase your product now &' pay for that in full within one month. If you choose this option, you will not be charged interest. It's now possible to spread out the purchase cost across six to 36 months.

When authorizing you for its offerings, Klarna does soft credit checks, which have no effect on your credit report. If you fund your purchase for four or thirty months, you won't pay the interest. Payments that are seven days or more late will incur a cost of seven dollars for each missed payment, up to a maximum fee of 25 percent of your purchase value.

Paypal

You may use PayPal Credit to purchase online at any merchant that accepts PayPal. Your PayPal account is linked to your credit card. As a result, if a problem arises with a transaction, PayPal's Purchase Safeguard will reimburse you. You'll have a $250 limit on your credit card if you're authorized. A hard credit draw on your account will be performed as a result of PayPal using Synchrony to examine your request, which might have an adverse effect on your credit score.

Spending more than $98 in a single transaction qualifies you for interest-free credit for six months. Utilizing the application is the same as paying with cash as long as you meet the minimum payment requirements and pay off the debt before the time period ends. A 23.98 percent variable interest percentage applies to any purchases under $99, regardless of how much you spend. However, if you pay off your credit card balance in full each month, you may avoid this fee. You may use your credit card for cash advancements to transfer money to loved ones. However, there are exceptions to this rule, regardless of how much money is involved in a transaction.

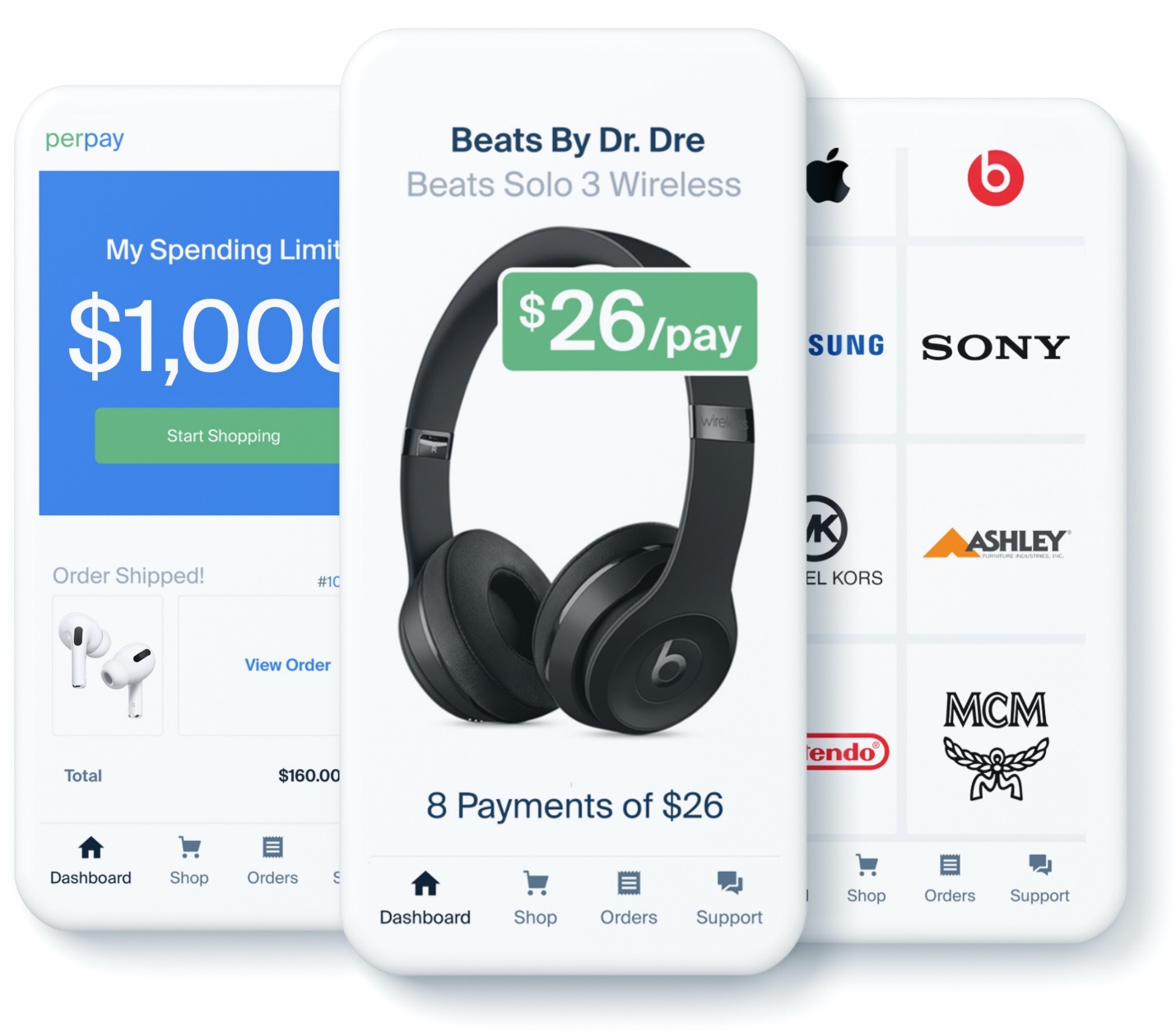

Perpay

In order to assist people in establishing credit, Perpay created a buy-now, pay-later app. There are no hard credit checks when you join up and make transactions. You may improve your credit record and credit rating by making regular payments using Perpay, which will be reported to the three major credit agencies, Equifax, Experian, &' TransUnion.

When you buy anything using Perpay, you won't have to pay until your next paycheck. Your things won't be sent until you make the initial payment, which is the only catch. You'll pay on a regular basis, based on your salary. If you get paid on a monthly basis, for example, you will also make payments on a monthly basis. While a hard inquiry isn't required to join Perpay, you must have steady employment. Pay stubs will be required to confirm your income. On purchases, you won't incur interest or fees.

Conclusion

Apps that allow users to buy now and pay later are becoming more popular. In order to protect individuals from falling into debt, they may provide interest-free loans and repayment plans that are easy to understand. Affirm is our top pick for the finest buy-now, pay-later app. In contrast to many of its rivals, Affirm does not impose late fees. Payments may be made online or in-store, depending on your preference and financial situation.

Life Estate vs. Irrevocable Trust: An Overview

Feb 28, 2024

Irrevocable trusts and life estates are utilized in estate planning. Transferring substantial assets like a house in the life estate or irrevocable trust could help an individual qualify for Medicaid; however, this will depend on the state's law. Life estates share ownership between the receiver and the giver.

Who Are The Unbanked?

Oct 06, 2023

Unbanked people have no bank or credit union accounts. Unbanked households have no bank accounts. Unbanked persons use check cashing, payday lending, rent-to-own businesses, and auto title loans instead of checking, savings, or money market accounts.

The Hartford Insurance Reviews: A Complete Guide

Nov 17, 2023

The Hartford is a Fortune 500 insurance provider that offers home and vehicle insurance in all 50 states and has been in business since 1810. Hartford is not well known for having a substantial home and auto insurance market share. Still, it significantly impacts mutual funds, corporate insurance, and employee group benefits. Hartford's collaboration with the AARP is aimed at people 50 and older. Hartford will offer AARP members savings and benefits for its home and vehicle insurance products

How To Trade Silver Successfully

Dec 03, 2023

Learn how to trade silver successfully with our step-by-step guide. Discover the different strategies and tips used by experienced traders that will help you maximize your profits when trading silver.

What Should you Need to Know While Contingent Contracts for Trying to Find a New Home?

Oct 31, 2023

If the seller is anxious about finding a new place to live, they might condition the sale on the successful purchase of another residence. In its stead, the contingencies clause should specify when the accepted proposal becomes binding, and the clock begins ticking toward closure.

Quick Guide on Mortgage Impound Accounts

Dec 15, 2023

Impound accounts, also known as escrow accounts, are established by your mortgage provider to pay for certain property-related expenses. A percentage of your monthly mortgage payment is used to fund the account.

Home Equity Loans

Feb 19, 2024

You may borrow against the value of your home with a home equity loan, a form of a second mortgage. You use your home itself as collateral to secure the loan.

Way to Calculate the Intrinsic Value of Preferred Stocks

Feb 06, 2024

Though they have the status of equity securities, steady payouts and lack of voting rights make them more akin to debt instruments. Preferred shareholders get dividends before common shareholders and have preference in the case of a bankruptcy or liquidation of the company's assets.

Creating financial projections for your business

Dec 30, 2023

creating financial projections for your business requires you to work on your business progress and promotion with proper planning and effective outcomes by managing risks.

Best Providers for Low-Cost Auto Insurance (July 2022

Nov 30, 2023

According to the most recent CPI figures, the rising cost of food and energy is causing inflation in the automobile insurance business. Auto insurance costs are growing in tandem with the cost of other goods and services. Finding strategies to save money on vehicle insurance is more crucial than ever

Credit Card Cost

Feb 19, 2024

When you borrow money, fees will always be attached to it, and you want to ensure that these fees don't catch you off guard. If you are aware of the costs associated with using a credit card, you will be better able to determine whether or not you want to use a credit card as a payment option

Top Fidelity Funds for Aggressive Stocks

Nov 12, 2023

investing in the best fidelity funds for aggressive stocks is the right choice to make the volume growth on your investment. Check out the best options before you invest.