Things to Consider When Starting a Mutual Fund

Nov 10, 2023 By Triston Martin

During the last several decades, mutual funds have become one of the most common investment vehicles. The dismal reality is that most mutual funds have underperformed the overall stock market. There are times when investors have the notion that they may establish their mutual fund, but they must be informed of all involved.

Understanding Mutual Funds and Loads

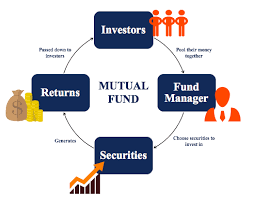

Mutual funds are investment vehicles that pool together money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. When you invest in a mutual fund, you are buying shares in this collective investment and benefiting from the expertise of a portfolio manager who handles the buying and selling of the fund's assets. However, this management and administration come with costs that are borne by investors.

Understanding Expense Ratios and Loads

Expense Ratio: This is an annual fee expressed as a percentage of the fund's total assets and covers operational costs including management fees, administrative fees, and other expenses. The expense ratio is deducted from the fund's assets, thus reducing investors' returns. It’s important to compare expense ratios when choosing between funds, as a higher expense ratio can significantly eat into your investment returns over time.

Loads: Mutual funds may also come with loads, which are fees charged to investors when buying or selling shares. Loads are classified into two main types:

- Front-End Loads: Charged when you purchase shares of a mutual fund. This fee is subtracted from your initial investment. For example, if you invest $1,000 in a mutual fund with a 5% front-end load, $50 goes to the load, and $950 is actually invested in the fund.

- Back-End Loads (or deferred sales charges): Charged when you sell your shares, typically decreasing to zero if you hold your shares long enough. This incentivizes investors to stay invested in the fund for a longer period.

No-Load Funds: These funds do not charge any type of sales load. However, they may still carry other types of fees, like a higher expense ratio or a 12b-1 fee (a marketing or distribution fee).

Before You Get Started

By conducting your research, you may lay the groundwork for constructing your portfolio of stocks. The expenditure of your time will, in the long run, result in cost savings for you. The only expenditure you will incur when buying and selling stocks is the charge associated with the transaction.

It is essential to start with a solid stock selection to avoid incurring ongoing trading costs. If you have to rebalance your fund regularly, the trading fees will negatively influence the returns your fund generates. Remember that not all mutual funds serve the same purpose in the same way. Look for mutual funds with an expense ratio of less than one percent if you don't have the time or desire to develop your portfolio of investments.

Staying Ahead

When evaluating the performance and appropriateness of an investment fund, understanding how it compares to relevant benchmarks and other funds in the same category is crucial. Here’s how you can assess a fund’s worthiness based on its performance, expenses, and comparison to industry standards.

Key Factors in Fund Evaluation

Benchmark Performance: Each mutual fund should be compared against a standard benchmark, which serves as a barometer for its performance. For many equity funds, the Standard & Poor's 500 Index (S&P 500) is a common benchmark, but other indexes might be used depending on the fund’s focus, such as sector-specific or international indexes. Evaluating how well the fund tracks or outperforms its benchmark gives you an insight into the fund manager's skill and the fund's potential value to your portfolio.

Relative Performance to Peers: In addition to benchmark comparison, assessing how a fund performs relative to its peers provides further insight. This involves looking at other funds with similar investment strategies or targets. Tools like Morningstar and Lipper rank funds based on various criteria including performance, risk, and expenses, making it easier to see how a fund stands out in its category.

Expense Ratios and Loads: High fees can eat into your investment returns significantly over time. Analyzing the expense ratio and any associated load fees is critical. No-load funds and those with low expense ratios are generally preferable, especially if their performance is on par with or better than peers that charge higher fees.

Analysis Tools: Using tools like those provided by Morningstar and Lipper can simplify the process of evaluating a fund. By entering the fund's ticker symbol, you can access a wealth of information including historical performance data, expense details, manager tenure, and risk assessments. This data is vital for making informed decisions about whether to hold onto a fund or look for alternatives.

Index Funds

Putting money into an index fund, which is a kind of fund highly associated with a specific index (like the Dow Jones or the Nasdaq), is another choice that investors should consider carefully and consider seriously. Because these funds do not routinely trade or change over stocks, their expenditures are kept to a minimum; these funds usually do not require investors to pay load fees. Jack Bogle and the Vanguard family of funds are widely regarded as the pioneers of low-cost index investing for life, according to professionals in the relevant industry.

You are at the mercy of the index's composition if you invest in index funds, which is one of the fundamental risks associated with making that investment. That is to say, if the components that make up the S&P 500 or the Dow Jones alter, you will be subject to an impact that financial professionals refer to as a rebalancing effect. In addition, many people make the compelling case that these indices are sluggish to adjust to the state of the economy.

Top Fidelity Funds for Aggressive Stocks

Nov 12, 2023

investing in the best fidelity funds for aggressive stocks is the right choice to make the volume growth on your investment. Check out the best options before you invest.

A Guide To Investing Your First $100,000

Feb 15, 2024

Security and long-term aspirations are two reasons to save. A solid financial foundation gives you the confidence to handle unexpected bills, save for retirement, and live comfortably.

Successfully Live Within Your Means

Dec 05, 2023

That's good news since it implies you're able to put some cash away each month after paying all of your expenditures. Living below your means can help you save money and develop wealth more quickly.

What Is a Budget? Tips To Make It

Dec 24, 2023

Budgeting is an important foundational skill for managing one's own money. However, the term "budget" might evoke negative connotations. Additionally, there are many approaches to budgeting, but ultimately, it all comes down to arranging one's financial resources and keeping tabs on their use. Budgeting should liberate you, not bind you.

Gold vs. Platinum Amex Card: What's the Difference?

Dec 21, 2023

Very few cards offer the same benefits and perks as the Platinum Card from American Express and the American Express Gold Card. Both cards come with a high earnings potential, high-quality welcome bonus offers, and an array of perks that, if used by an appropriate person, could easily surpass the annual cost of ownership.

What exactly is meant by the term "sovereign credit rating"?

Dec 10, 2023

A nation's creditworthiness is measured by its sovereign credit rating. Since it is used for all government-issued bonds, it demonstrates the risk involved in financing a country.

Comparison Between FutureAdvisor and Betterment

Nov 05, 2023

Betterment and FutureAdvisor are totally different robo-advisories, but they both approach investing in a similar way. Although the specifics of portfolio construction and rebalancing differ, both, like other robo-advisors, heavily depend on Modern Portfolio Theory (MPT). Furthermore, FutureAdvisor and Betterment both incorporate tax loss collecting as part of the package, unlike certain robo-advisors that charge a premium for this feature.

Credit Card Cost

Feb 19, 2024

When you borrow money, fees will always be attached to it, and you want to ensure that these fees don't catch you off guard. If you are aware of the costs associated with using a credit card, you will be better able to determine whether or not you want to use a credit card as a payment option

Way to Calculate the Intrinsic Value of Preferred Stocks

Feb 06, 2024

Though they have the status of equity securities, steady payouts and lack of voting rights make them more akin to debt instruments. Preferred shareholders get dividends before common shareholders and have preference in the case of a bankruptcy or liquidation of the company's assets.

The Best Cell Phone Insurance 2022

Oct 08, 2023

Many cellphone insurance policies provide comparable coverage, but evaluating each insurer and policy is crucial before choosing one carefully. The best cellphone insurance plans have affordable low deductibles and make filing a claim simple. When choosing a service, additional elements like bundle discounts, multi-device possibilities, and client reviews may also be helpful.

How To Trade Silver Successfully

Dec 03, 2023

Learn how to trade silver successfully with our step-by-step guide. Discover the different strategies and tips used by experienced traders that will help you maximize your profits when trading silver.

What Should you Need to Know While Contingent Contracts for Trying to Find a New Home?

Oct 31, 2023

If the seller is anxious about finding a new place to live, they might condition the sale on the successful purchase of another residence. In its stead, the contingencies clause should specify when the accepted proposal becomes binding, and the clock begins ticking toward closure.