All About AmEx Pay It Plan It

Nov 04, 2023 By Triston Martin

American Express introduced a limited beta of a payment planning tool called Pay It Plan It a few years back. Recently, the program's reach was extended to include a more significant number of American Express credit cards in the United States.

We'll explain how Pay It Plan It works and who can benefit from it because American Express's Pay It Plan It program is available on some cardholders' accounts.

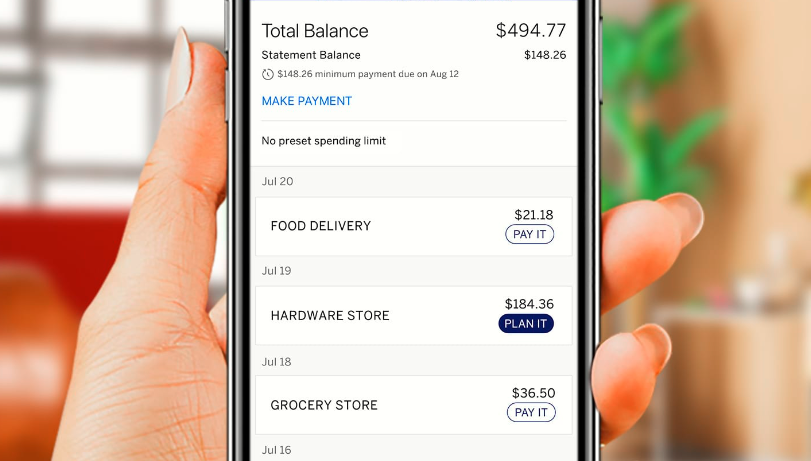

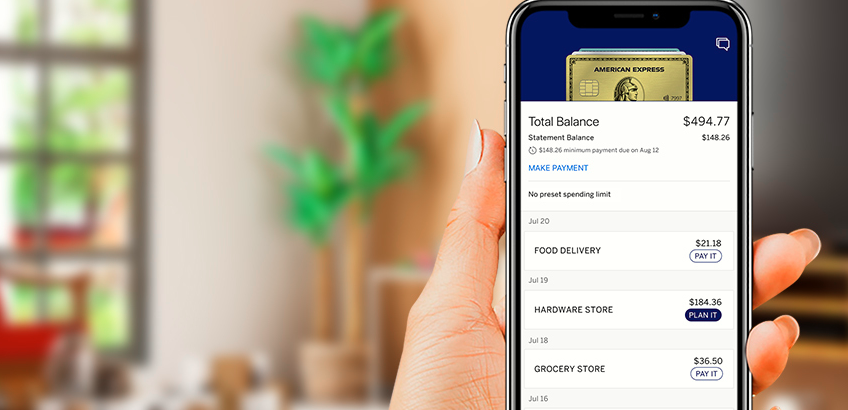

It's Your Turn to Pay Up. Instantly settling purchases under $100 on your credit card is an option. In the American Express app, the option will appear under the dollar amount while seeing the specific charges for your qualifying card.

You can use the Pay It functions by selecting the amount of a qualified purchase you want. Next, make the payment; after 24 to 36 hours, you should see the credit in your account. When using Pay It, you can pay off many charges at once and still be eligible for prizes for early payments.

Truth That Needs to Be Known

It's possible to make smaller payments on your credit card balance monthly using Pay It. When you use Pay It through the app, you can choose individual purchases to pay off, but the money you send is not applied as a credit to any particular transaction. Instead, it will be applied to your minimum monthly balance to reduce your overall debt.

There is no benefit to spreading out your credit card payments throughout the month unless you're utilizing it as a budgeting tool. You'll lose out on interest you could have earned by keeping the money in your bank account and will be sending American Express money before it's needed.

Make a Strategy If you have charges of $100 or more, you can pay them off over time and avoid the interest that would usually be added to your account. When you set up a payment plan, you'll be asked to agree to a monthly plan cost, a fixed finance charge. Checking your app or online account for qualified expenses will allow you to use Plan It.

Start using Plan It by selecting the charge you wish to add to a plan by tapping or clicking on it. Then, you will be allowed to choose between one and three different plan durations. If you click on a different plan, you can learn more about it and see the consistent monthly cost. Choose the Plan you wish to utilize, check out the finer points, and click "Confirm" to finalize the setup. When using Plan It, you can still accumulate points in the same manner as with any other purchase.

After establishing a payment plan, its monthly payment becomes part of the required minimum payment. You should be prepared to pay your total monthly due, including plan payments, each month, as this may increase your minimum monthly payment, especially if you put up many significant charges on plans.

Consequences, Strategies, and Arrangements

You can only have ten plans in effect at once with American Express. There is a significant difference between making a plan using your online account and making a plan through the American Express mobile app. You can bundle up to ten qualified purchases through your online account into a single payment plan. Dreams can only be created with one eligible purchase per Plan in the app.

The problem arises if you want to arrange for any charges to be made at once on your account. You can add up to one hundred payments to your plans using your online account (10 orders for each of the ten goals). The software only allows you to add ten charges to your projects (1 control for each).

Predictive Analyzer for Strategic Planning

The American Express Pre-Purchase Calculator can be used to get a feel for the Plan It features before you commit to using it. After logging into your account and choosing a Plan It-compatible card, the calculator will become available. The calculator can be used regardless of whether or not there are any qualifying purchases on the card.

The Pre-Purchase Calculator provides example plans with 3, 6, and 12-month payoffs once you enter an initial purchase price. The calculator also includes other information, such as the monthly plan charge, total plan fee, and total amount paid, in addition to the minimum monthly payment.

Even though you were required to log in, the calculator does not reflect the plan terms you will be provided. Your Amount Available to Plan and credit limit will still be considered. The Pre-Purchase Calculator is great for learning the ins and outs of the function, but it is of little value for budgeting for future purchases on your particular account.

Comparison Between FutureAdvisor and Betterment

Nov 05, 2023

Betterment and FutureAdvisor are totally different robo-advisories, but they both approach investing in a similar way. Although the specifics of portfolio construction and rebalancing differ, both, like other robo-advisors, heavily depend on Modern Portfolio Theory (MPT). Furthermore, FutureAdvisor and Betterment both incorporate tax loss collecting as part of the package, unlike certain robo-advisors that charge a premium for this feature.

Successfully Live Within Your Means

Dec 05, 2023

That's good news since it implies you're able to put some cash away each month after paying all of your expenditures. Living below your means can help you save money and develop wealth more quickly.

Champions School of Real Estate Review in Detail

Feb 02, 2024

With licence courses in real estate, loan origination, house inspection, and appraisal, Champions provides a great deal of opportunity to persons interested in working in all aspects of the real estate industry. In addition to that, they provide a comprehensive selection of credentials that real estate agents and brokers can earn.

The Best Cell Phone Insurance 2022

Oct 08, 2023

Many cellphone insurance policies provide comparable coverage, but evaluating each insurer and policy is crucial before choosing one carefully. The best cellphone insurance plans have affordable low deductibles and make filing a claim simple. When choosing a service, additional elements like bundle discounts, multi-device possibilities, and client reviews may also be helpful.

Investing In A Foreclosed House

Dec 31, 2023

A home in pre-foreclosure is in financial difficulties but has not yet been repossessed by the lender and put up for auction. Property owners who have fallen behind on their mortgage payments but are still living in their pre-foreclosure houses are the norm. Pre-foreclosure homeowners have been served with a default notice but may be making efforts to prevent the sale of their house from proceeding..

Way to Calculate the Intrinsic Value of Preferred Stocks

Feb 06, 2024

Though they have the status of equity securities, steady payouts and lack of voting rights make them more akin to debt instruments. Preferred shareholders get dividends before common shareholders and have preference in the case of a bankruptcy or liquidation of the company's assets.

Best Time To Buy A Car

Dec 19, 2023

A new car is one of the most significant purchases you may make in any given year, regardless of whether you're buying it as a present for someone else or as a treat for yourself.

Top Fidelity Funds for Aggressive Stocks

Nov 12, 2023

investing in the best fidelity funds for aggressive stocks is the right choice to make the volume growth on your investment. Check out the best options before you invest.

Quick Guide on Mortgage Impound Accounts

Dec 15, 2023

Impound accounts, also known as escrow accounts, are established by your mortgage provider to pay for certain property-related expenses. A percentage of your monthly mortgage payment is used to fund the account.

Gold vs. Platinum Amex Card: What's the Difference?

Dec 21, 2023

Very few cards offer the same benefits and perks as the Platinum Card from American Express and the American Express Gold Card. Both cards come with a high earnings potential, high-quality welcome bonus offers, and an array of perks that, if used by an appropriate person, could easily surpass the annual cost of ownership.

Life Estate vs. Irrevocable Trust: An Overview

Feb 28, 2024

Irrevocable trusts and life estates are utilized in estate planning. Transferring substantial assets like a house in the life estate or irrevocable trust could help an individual qualify for Medicaid; however, this will depend on the state's law. Life estates share ownership between the receiver and the giver.

Creating financial projections for your business

Dec 30, 2023

creating financial projections for your business requires you to work on your business progress and promotion with proper planning and effective outcomes by managing risks.