Learn and Understand: What Is Business Interruption Insurance?

Oct 05, 2023 By Susan Kelly

Introduction

Business interruption insurance is a form of protection that covers lost revenue when a company is closed due to physical harm or loss, such as that brought on by a fire or other natural disaster. This kind of insurance covers running costs, migration to a temporary residence if it becomes necessary, payment of taxes, and loan repayment. Business interruption insurance may occasionally be applicable when a company is shut down by a civil authority due to physical damage to a neighboring business, causing a loss for the company. If a business closes due to the spread of a pandemic, policyholders are not protected by the typical business interruption insurance policy. Some all-risk insurance contracts have specific exclusions for harm from bacteria or viruses.

What Is Business Interruption Insurance?

What is business interruption insurance? Like other business expenses, the cost of business interruption insurance (or, at the very least, the added costs of the insurance) is tax deductible. Only if the property/casualty coverage of the policy covers the reason for the loss in business income will this type of insurance pay up. The company's financial accounts often serve as the basis for calculating the amount due.

According to the insurance policy terms, business interruption insurance is valid until the end of the interruption period. According to the Insurance Information Institute, a typical policy has a 30-day expiration date but can be extended to 360 days with an endorsement. 1 Most commercial interruption insurance policies define this period as starting when the occurrence was first covered and ending until the damaged property is returned to its pre-catastrophe condition. There can also be a waiting period of 48 to 72 hours.

What Is Covered Under Business Interruption Insurance?

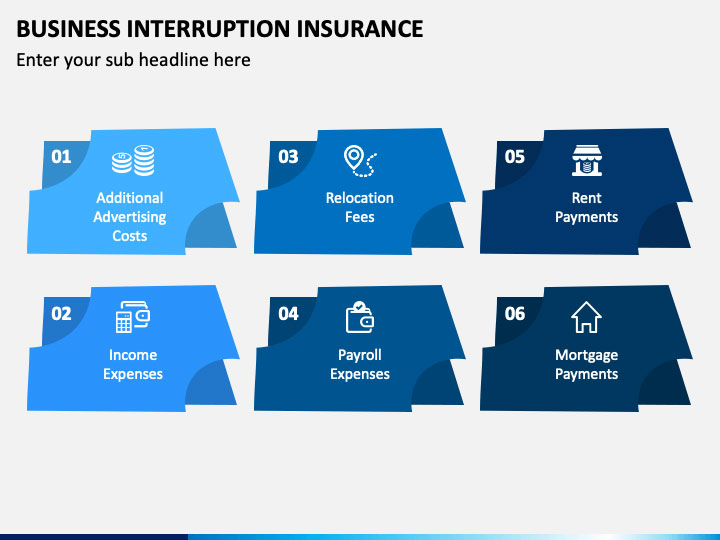

Your interruption insurance might help with the following running expenses if a covered loss forces your company to shut down:

- The average salary you'd receive from an open-ended business.

- Rent, mortgage payments, and lease fees for your firm's space.

- To pay for the time, you will have to make loan installments.

- Taxes, whether you pay them on a monthly or quarterly basis.

- The wages you pay your employees.

- Expenses associated with moving should you be forced to do so because of physical harm.

- Additional costs include when you need to rent a second location for your firm after a loss you have already covered.

- The price of training staff members to operate new machinery or equipment after a loss is covered.

Restoration Period for Business Interruption Coverage

The time frame during which your business interruption insurance will cover income loss is known as the restoration period. Typically, there is a 48–72 hour waiting period before your policy's income protection starts to take effect. Look up the procedure to determine when your restoration period starts and ends.

How Much Coverage Do I Need for Business Interruption Insurance?

There is a specific amount of coverage for each commercial interruption insurance plan. In the event of an expense, it is the sum you choose to acquire. Calculating how much business interruption insurance you'll need can be challenging. Utilizing your profits and predictions to predict future profits and calculate the right amount of insurance is a competent rule of thumb. Remember that you'll be responsible for any additional fees incurred if your business interruption expenses exceed the maximum coverage you choose. You can ask yourself the following questions to determine how much insurance you need:

- How long would it take your business to recover from a mishap or physical harm?

- Do your company's facilities have modern fire alarms and sprinkler systems?

- If you've lost anything, Do you believe you could find a new site in your area to rent out temporarily for commercial purposes?

A few insurances additionally cover business interruptions brought on by:

- those who can't enter your property to conduct business

- damage that occurs to a customer or supplier's property

- specialized insurance plans can protect your business's computers from hackers, malware, and other online dangers.

It is stated; that your business interruption insurance claim will cover the following expenses:

The situation affects your business's management costs, such as any additional accounting fees you might incur.

Business interruption insurance is typically offered as an additional option to business insurance plans, which combine several different policies into a single fee. In addition to building and content insurance plans, it is also a choice.

Conclusion

Only if the insured incurred costs due to the disruption is the insurer obligated to pay the claim. The amount paid by the company cannot exceed the maximum sum the insurance policy allows.

What Is a Budget? Tips To Make It

Dec 24, 2023

Budgeting is an important foundational skill for managing one's own money. However, the term "budget" might evoke negative connotations. Additionally, there are many approaches to budgeting, but ultimately, it all comes down to arranging one's financial resources and keeping tabs on their use. Budgeting should liberate you, not bind you.

Who Are The Unbanked?

Oct 06, 2023

Unbanked people have no bank or credit union accounts. Unbanked households have no bank accounts. Unbanked persons use check cashing, payday lending, rent-to-own businesses, and auto title loans instead of checking, savings, or money market accounts.

Features of Defensive Stock

Dec 04, 2023

A stock is considered defensive if it can continue to pay dividends and maintain steady profits regardless of the situation of the general stock market.

Champions School of Real Estate Review in Detail

Feb 02, 2024

With licence courses in real estate, loan origination, house inspection, and appraisal, Champions provides a great deal of opportunity to persons interested in working in all aspects of the real estate industry. In addition to that, they provide a comprehensive selection of credentials that real estate agents and brokers can earn.

Everything You Should Know About Personal Liability Insurance Coverage

Jan 21, 2024

An important function of liability insurance is to assist policyholders in meeting their financial obligations if they accidentally or negligently cause financial harm to another individual or their property. The primary benefit of liability insurance is that it pays for expenses associated with treating or repairing injuries sustained by third parties and damage to their property

Best Time To Buy A Car

Dec 19, 2023

A new car is one of the most significant purchases you may make in any given year, regardless of whether you're buying it as a present for someone else or as a treat for yourself.

How New York Became A Financial Center

Nov 15, 2023

Wall Street is the core of American finance, even if London is the world's biggest financial city. Not always, though. The first bank and stock exchange in the U.S. were created in Philadelphia, not New York City.

Top Best Buy Now, Pay Later Apps in 2022

Feb 09, 2024

The "buy now, pay later" financing scheme has grown in popularity over the last few years, partly because of the pandemic's impact on the internet shopping. With these programs, your monthly payment is divided into many equal payments with no interest or charges, making it easier for you to manage your finances. In certain cases, plans may be used both digitally and in shops, depending on the application.

Top Fidelity Funds for Aggressive Stocks

Nov 12, 2023

investing in the best fidelity funds for aggressive stocks is the right choice to make the volume growth on your investment. Check out the best options before you invest.

What Should you Need to Know While Contingent Contracts for Trying to Find a New Home?

Oct 31, 2023

If the seller is anxious about finding a new place to live, they might condition the sale on the successful purchase of another residence. In its stead, the contingencies clause should specify when the accepted proposal becomes binding, and the clock begins ticking toward closure.

Things to Consider When Starting a Mutual Fund

Nov 10, 2023

Investors who take part in a company-sponsored retirement plan or who have an individual investment portfolio are frequently confronted with a bewildering selection of funds to choose from, many of which they do not fully understand in terms of their potential impact on the value of their investment as a whole.

The Hartford Insurance Reviews: A Complete Guide

Nov 17, 2023

The Hartford is a Fortune 500 insurance provider that offers home and vehicle insurance in all 50 states and has been in business since 1810. Hartford is not well known for having a substantial home and auto insurance market share. Still, it significantly impacts mutual funds, corporate insurance, and employee group benefits. Hartford's collaboration with the AARP is aimed at people 50 and older. Hartford will offer AARP members savings and benefits for its home and vehicle insurance products